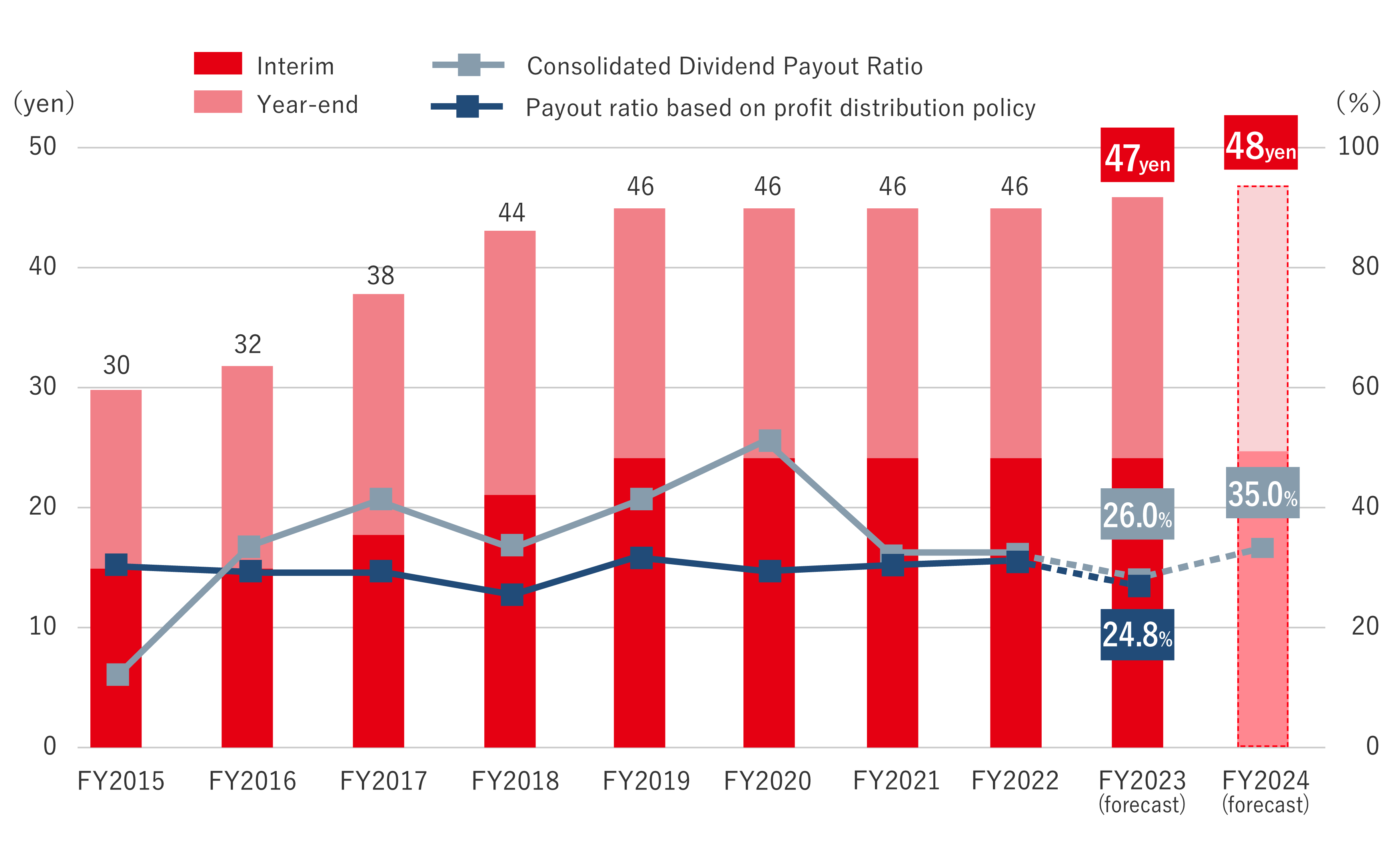

Recognizing that one of the key management issues is the return of profits to shareholders, the Group endeavors to increase its earnings power and improve its financial position. In addition, our basic policy on the payment of dividends is “Total return ratio of 40% or higher” and ”Ongoing payment of annual dividends of at least 46 yen as stable dividends,“ while comprehensively considering the consolidated business results and the business plans, among other aspects.

(During the period of the Eighth Medium-term Business Plan, since we will pursue treasury share acquisitions funded by reductions in cross-shareholdings, we will aim to improve the total return ratio to at least 50%.)

Basic policy on the payment of dividends until the fiscal year ended March 2024:

Continued to pay stable dividends with a consolidated payout ratio of 30% as the basis

(Excluding the effects of extraordinary income/losses arising from business combination and the amortization of goodwill)

| Interim (yen) | Year-end (yen) | Annual Total (yen) | Consolidated Dividend Payout Ratio (%) |

Total return ratio (%) |

※Payout ratio based on profit distribution policy (%) |

|

|---|---|---|---|---|---|---|

| FY2016 | 15 | 17 | 32 | 37.9 | - | 30.4 |

| FY2017 | 18 | 20 | 38 | 41.7 | - | 30.4 |

| FY2018 | 22 | 22 | 44 | 32.8 | - | 26.2 |

| FY2019 | 23 | 23 | 46 | 40.4 | - | 31.6 |

| FY2020 | 23 | 23 | 46 | 53.1 | - | 29.7 |

| FY2021 | 23 | 23 |

46 |

32.9 |

- | 31.8 |

| FY2022 | 23 | 23 | 46 | 32.9 | - | 32.4 |

| FY2023 | 23 | 24 | 47 | 26.0 | 37.4 | 24.8 |

| FY2024 | 24 | 24 | 48 | 36.4 | 84.4 | - |

| FY2025 | 24 | 24 (forecast) |

48 (forecast) |

34.1 (forecast) |

- | - |

The shareholder benefit program has been changed to a selective system.

Please find more details from the following page.

| Number of Shares Held | Description |

|---|---|

| 100 to less than 200 shares | Selected from a group product assortment,donation,etc. Equivalent to 1,000 yen |

| 200 to less than 1,000 shares | Selected from a group product assortment,donation,etc. Equivalent to 2,000 yen |

| 1,000 shares or more | Selected from a group product assortment,donation,etc. Equivalent to 3,000 yen |

| Number of Shares Held / Description | 100 to less than 200 shares / Selected from a group product assortment,donation,etc. Equivalent to 1,000 yen |

200 to less than 1,000 shares / Selected from a group product assortment,donation,etc. Equivalent to 2,000 yen |

1,000 shares or more / Selected from a group product assortment,donation,etc. Equivalent to 3,000 yen |

|---|

We donated funds equivalent to the shareholder benefit program of the shareholders who had selected a donation in the returns to the shareholders listed in the shareholder list as of March 31, 2024 and September 30, 2024 to Japan Kodomo Shokudo Support Center Musubie.

| No. of shareholders who selected donation | 1,990 |

|---|---|

| Total donation money | 2,785,000 yen |

| Donated on | February 28, 2025 |

Japan Kodomo Shokudo Support Center Musubie has set up a vision of "Creating a society that does not ignore anybody through support for children cafeterias (kodomo shokudo)" and is undertaking activities based on the following three pillars: Supporting the children cafeteria network in each region, connecting with companies and organizations that wish to contribute to society to deliver their support to children cafeterias, and continuing awareness building through surveys and studies.